The process of choosing a Medicare plan can leave most people feeling frustrated and completely confused. However, this one little tool can make the process a lot easier to find the right plan.

Guess what? It starts with your prescriptions!

Video Transcription

Hello there, this is Craig Prince from CAP Insurance Services. One of the questions that I get from people when it comes to Medicare is what is the right plan? And, since the federal government instituted Part D of Medicare, it has put an important part out there for a person to consider when they want to consider how they want to receive their Medicare benefits.

So, today I want to talk specifically about a great tool that you should use annually to help you to determine what plan is going to work out best for you. If you find the process just a little too much to handle, reach out to a medicare insurance agent for help.

Start With Your Prescription Medication

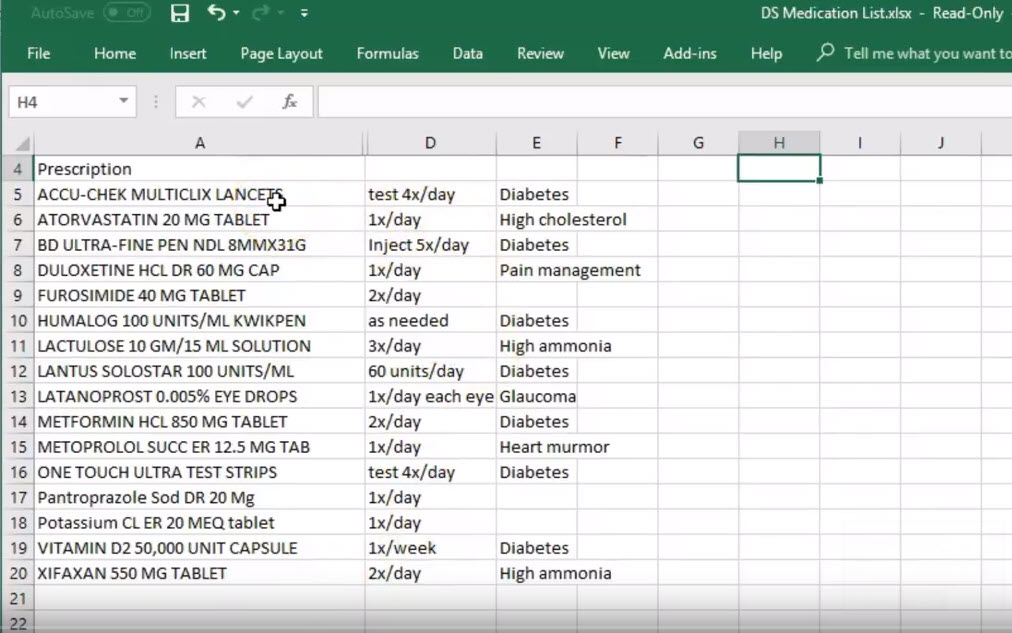

So, one of the things that I would tell you up front is that I often get from people a list of prescription drugs that might look like this. And, I'm just going to take this, and you can see that this list of prescription drugs that this person has sent to me, you've got basically 15 different prescription drugs.

I'll also talk about items. As an example, the Lancets are not a covered prescription by most prescription drug plans, but are part of the durable medical equipment that is covered by the plans. Some plans covered 80%, some of them covered a hundred percent. So, what I want to do is go through that right now. And, I'm going to start out by taking the list off the screen and I want to, basically, tell you how I would look at this

So, I would come into this and I would say, "I want to find health and drug plans." And, I'm going to simply use my own zip code right now, which is 91710 zip, but certainly these zips are according to what your needs are. You'll always come to this screen about how you get your Medicare coverage and did you get help from Medicare or did you state pay for prescription drug cost.

Unless you're on your Medicaid, or in California we call it Medi-Cal, what I would simple do is to start with, so that you don't have to worry about it, I'd simply put, "I don't know what coverage I have. I don't know if I get extra help. But, yes I want to add drugs, so I can see what that plan looks like."

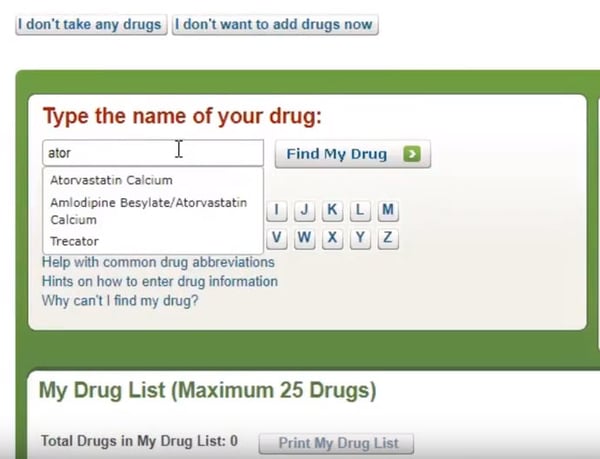

And, so what it does is it comes to a screen that's going to look like this and then, you can start putting your drugs in. So, the first drug that you might have seen on that list was Atorvastatin. And so as I go like this, the Atorvastatin Calcium, it brings up the dosage and it asks me dosage questions.

Enter Your Prescription Medication

So, this particular person takes a 20 mg tablet, so I'm going to put 20 milligrams. He takes it one time a day and he receives this. And, we're going to just assume that he receives it from a retail pharmacy, and I'm going to add the drug and dosage. Now, you notice the screen will reappear and it will show this drug.

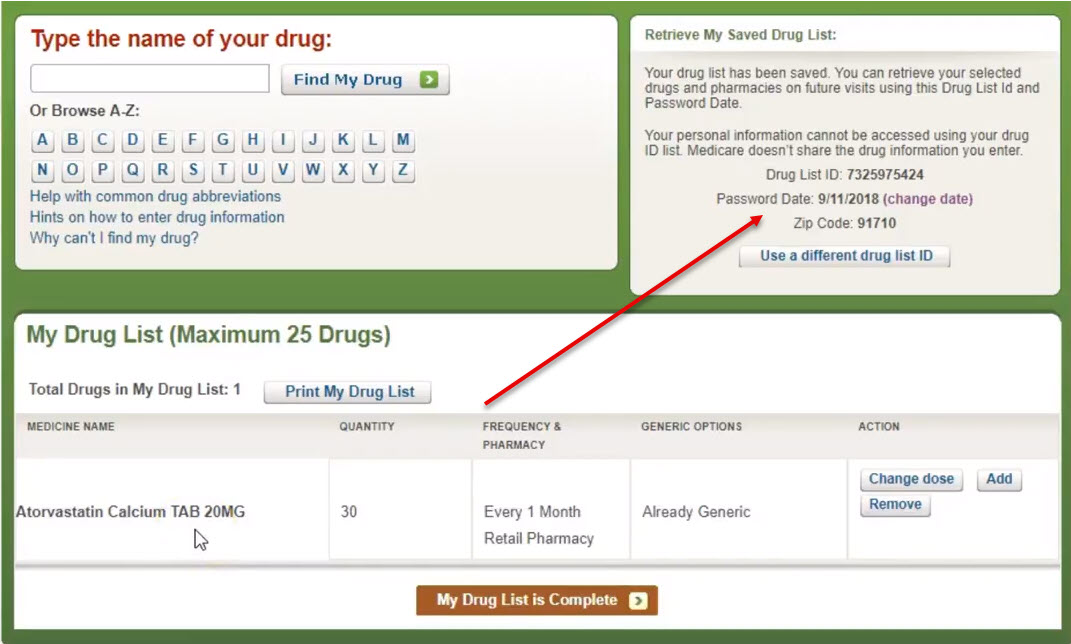

And, so what I want to do is not bore you with putting in each of the drugs, but I'll put in all the drugs for this particular individual, and then show you what that complete drug list is going to look like. So ... Okay, so now I'm bringing the list of drugs back over, you'll see that here's the list of drugs and when I ... What I've done is I've put the list in here and you can see that this list sits like this with the medicine name, the quantity, the frequency and everything that's available.

This person happens to have all of his material that he's getting in generic. And, what I want to do also is when you're looking at this list, you'll notice right up here, that it says, "This drug list is 7325975424."

Save Your Data

That drug list is important because that drug list, along with the date of 09/11/2018, will allow you to come back in to Medicare.gov, put that two pieces of information in and then, be able to pull the information back up without having to resubmit it or re-input it in the website. Otherwise, if you don't, and you want to come back and you haven't done that, then you'll have to put all your drugs back in.

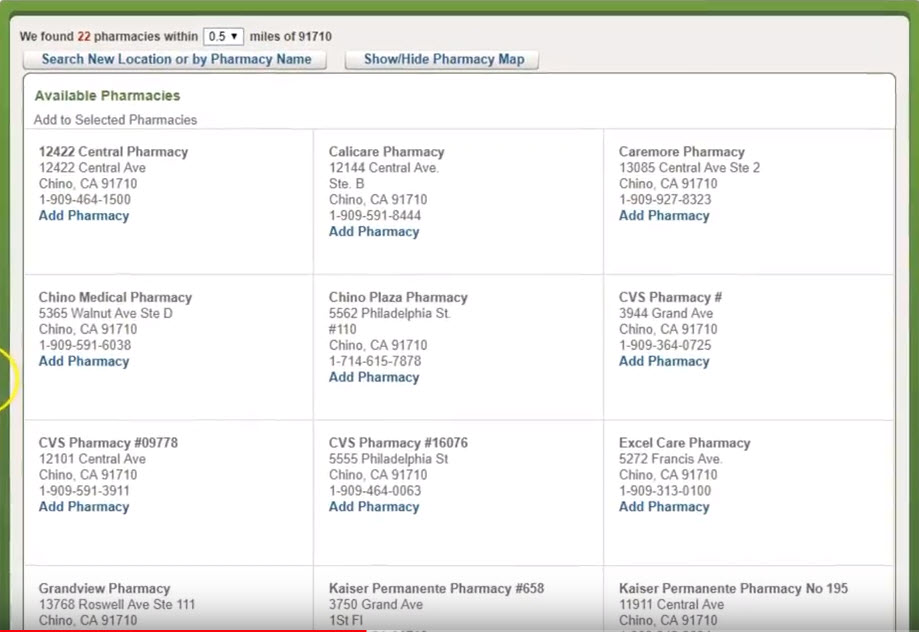

So, if your drug list is complete, I'm going to hit the complete and I'm just going to use a common pharmacy, like maybe a CVS pharmacy, because that's what I'd use. So, I'm going to add my pharmacy here, and by the way, you can add more than one pharmacy if you want it.

Choose A Pharmacy

It will show you where the best ... in other words, if you're used to using a pharmacy, you want a plan that's going to be not taking you out of your particular situation. So, now I'm going to go back, I'm going to go up to here to continue to plan results, and you will notice that there's pieces of information I can get now, particularly, I wanted to find out the plans that would best deal with my prescription drugs.

So, I can either take that prescription drug information and simply look up a prescription drug plan, we're talking about a stand-alone prescription drug plan, which is what I would use if I was putting Medicare in the primary position to be in the primary pair of my doctors and hospitals.

In other words, by Part A and Part B charges, I would need to pick up a prescription drug plan on a stand-alone basis.

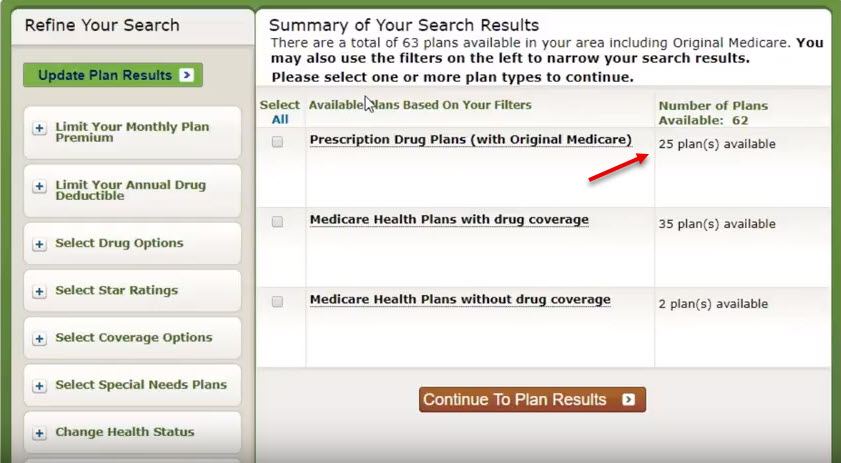

And so, what I'm going to do, is I'm going to first go here. And, what this says is that there's 25 plans that are available. And, what this will do, when I continue to plan results is this is going to put them in order of the best plan for my drugs, based on where I want to get my prescriptions filled, down to the worst one.

Search For A Prescription Plan

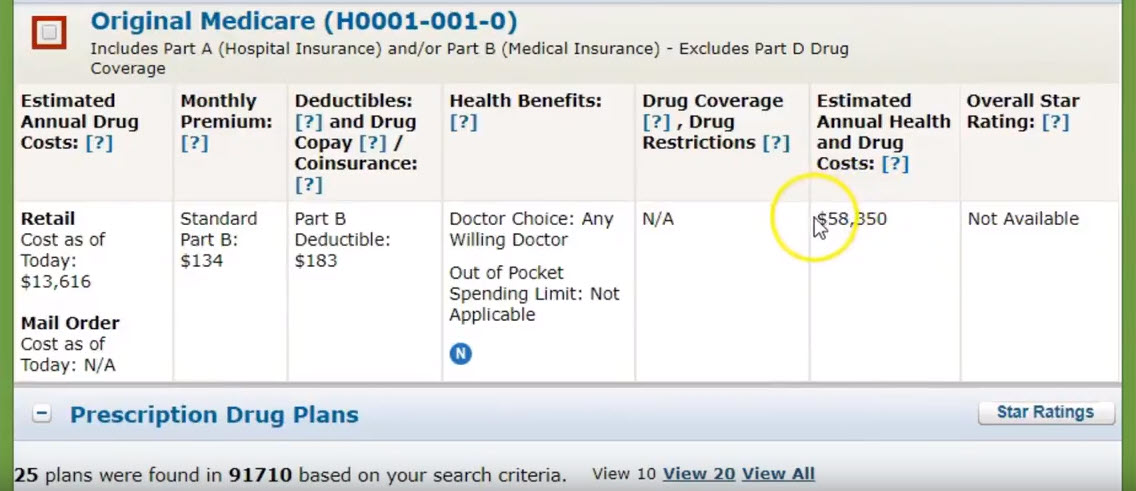

Okay? So, I'm going to ... I come down here, this is what original Medicare would be for this particular person, these drugs would be $58,350 and with considering the person getting them without insurance. The cost of these drugs with Medicare, if I had to pay them out of my own pocket, would be $13,616 per year. Okay?

So, I'm going to come down here, I want to view all the plans and I'm going to do this for a purpose, so you can see this.

Compare Prescription Costs

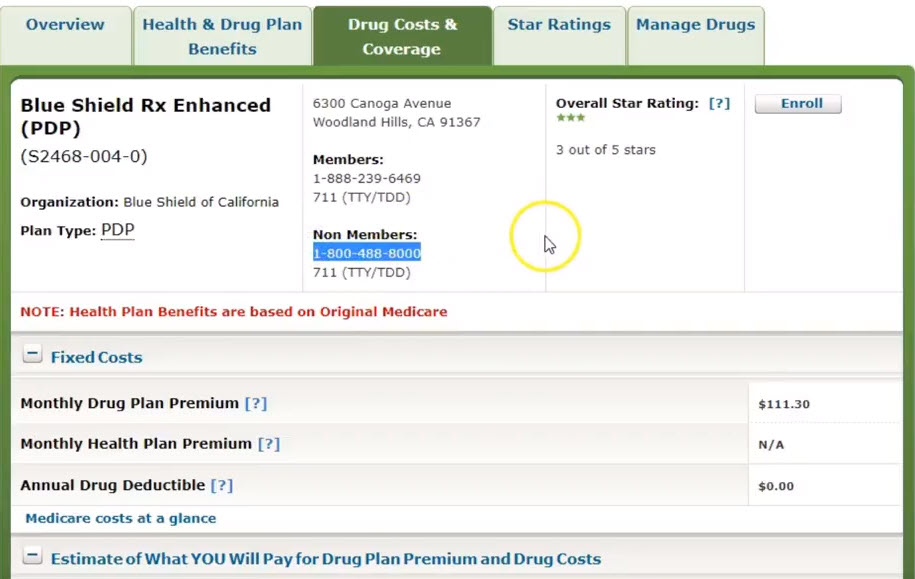

So, based on the particular drugs that I want to utilize, what this is saying, is that the Blue Shield RX Enhanced plan, which is $111.30 per month, would be the one that would handle my drugs the best. Now, if you look, cost as of today, mail-order cost as of today, if I look down here, my express scripts is actually about the same cost-share.

Okay. Almost exactly the same. A little bit less expensive on the premium, and by the way, this plan is a three out of five star plan, this one is a four out of five star plan. So, if all else were equal, I would certainly want a plan that would give me a little less premium and keep my cost down.

Again, I could go down here to the First Health plan, they've got one for $56.30, now that's almost saving me $600 a year, and again, my cost using the preferred pharmacy, is not that much different. This again, gives me a three out of five star plan.

So, I look at First Health, First Health is an Aetna product, and I may say, "Well, I like that," or, "I don't like that." Again, coming down here I see the United Health Care product. A little bit more on the cost-sharing on the pharmacy, but it actually gives me a little bit better on the mail-order. And so, the cost here is $94.50 per month, and by the way, that's the 2018 cost, and that's a four out of five star rated plan. All right?

So, if I go down here all the way to the very bottom, I can see that the plan that would be the worst for me would be the Anthem Blue Cross Medicare RX Standard prescription drug plan.

That plan would run $83.20 per month and it would give me an out-of-pocket of about $8,800. So, you can see that they vary from plan to plan. I want to look at several different things, star ratings is important, as well as other items that I'm looking at. And so, it's not a matter of choosing a plan that the broker wants to sell you, it's a matter of finding the plan that works best.

So, if the medicare insurance brokers talks to you about a plan and he doesn't represent the plan or you've gone on here and he doesn't represent the plan you want, you can simply click on ... we'll just show you this as an example ... I can click on this and it will actually take me to the website where non-members can call. And then, I can find out more information, including on how to enroll in that plan if that was the plan that I wanted to enroll in.

So this, again, the prescriptions is one component of this. Now, I'm going to go back up here and I'm going to refine my plan results, and I'm going to do this for a reason.

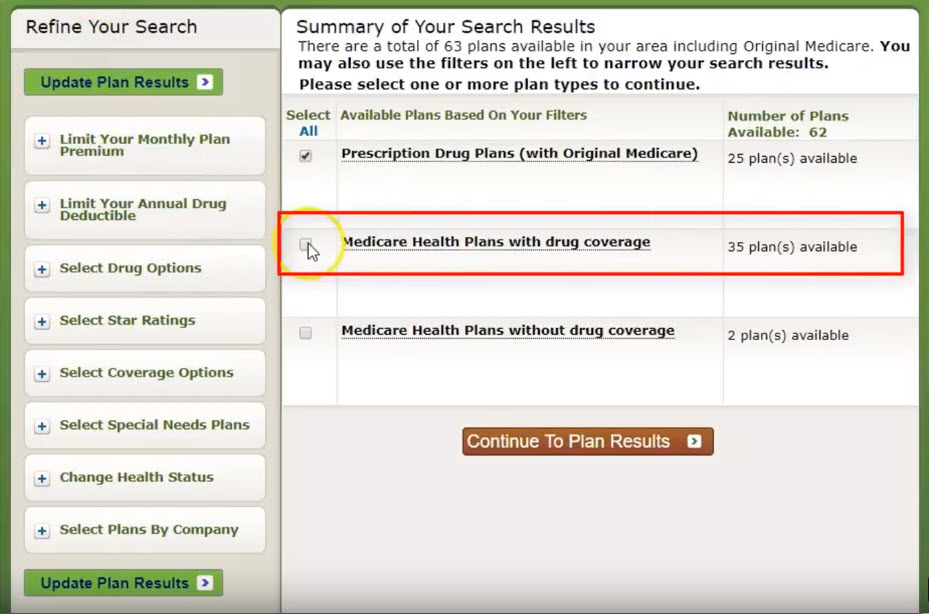

So, now, if I want a plan that's a Medicare Advantage plan, Part C of Medicare, a plan that will give me my health coverage plus my prescription drug coverage at little or no cost, then I'm going to go here.

So, I'm going to unhighlight this, highlight this and then, I'm going to, again, my drug list is the same, again. Keep in mind the information you see up here because that drug list in the password data are the two things that are going to get you back in to be able to see the prescriptions you're taking. Continue to plan results.

So, this tells me that if I look at Anthem StartSmart Plus, if that plan has the doctors that I want, has those as the providers that I want, it tells me that both my pharmacy cost or mail-order cost, is pretty low. This plan is a four and half out of five star rating, which is pretty high. This plan might be the plan that I would want to go for. All right?

So, again, it's not just as simple as finding the cheapest plan. Because the cheapest plan will not necessarily always have the doctors, the hospitals and/or the pharmacies that you like. It's coming up with all the components that will match the best possible scenario so that when you're finished and done with it, that you'll have a plan that will serve you and not just "serve" a broker.

“Statements on this website as to policies and coverage's and other content provide general information only and we provide no warranty as to their accuracy. Clients should consult with their licensed agent as to how these coverage's pertain to their individual situation. Any hypertext links to other sites or vendors are provided as a convenience only. We have no control over those sites or vendors and cannot, therefore, endorse nor guarantee the accuracy of any information provided by those sites or the services provided by those vendors.”