As part of the Revenue Act of 1964, the Internal Revenue Code established its Controlled Groups Provisions. These provisions were initially issued as part of a tax reform package intended to encourage small businesses, which operated in the corporate form.

Unfortunately, over time some medium and large businesses began to take advantage of the lower tax rates afforded to small businesses by organizing their structure into multiple corporate businesses. By doing this, they also sought to avoid providing employee benefits, such as health insurance, because each separate business wouldn’t meet the required number of employees that mandated that they provide those benefits.

As a result, additional codes were added to cover many of the arrangements devised by employers who attempted to avoid coverage of employees.

What is a Controlled Group?

The Internal Revenue Code outlines specific rules for controlled groups. These rules are used to determine if two or more employers must be grouped together and treated as a single employer for certain purposes. They apply to many employee benefit laws, such as non-discrimination and the Affordable Care Act’s (ACA) employer shared responsibility rules, in order to discourage employers from setting up multiple companies to avoid the law’s requirements.

Affordable Care Act’s (ACA) employer shared responsibility rules, in order to discourage employers from setting up multiple companies to avoid the law’s requirements.

Determining whether two or more organizations must be treated as a single employer under the controlled group rules involves a complex analysis of ownership interests, including constructive ownership interests.

Note: Because of these rule are so complex, controlled group status should be reviewed by legal counsel.

In General, a “Controlled Group exists if two or more corporations, trades or businesses (partnerships and proprietorships) have one of the following relationships:

Parent-subsidiary Controlled Group

A parent-subsidiary controlled group exists when one or more chains of organizations are connected through ownership of a controlling interest with a common parent organization if:

- A controlling interest in each of the organizations (except the common parent) is owned by one or more of the other organizations in the group; and

- The common parent organization owns a controlling interest in at least one of the other organizations.

For a corporation, “controlling interest” means ownership of stock having at least 80 percent of total combined voting power of all classes of stock entitled to vote, or at least 80 percent of the total value of shares of all classes of stock. For a partnership, “controlling interest” means at least 80 percent of profits interest or capital interest of the partnership.

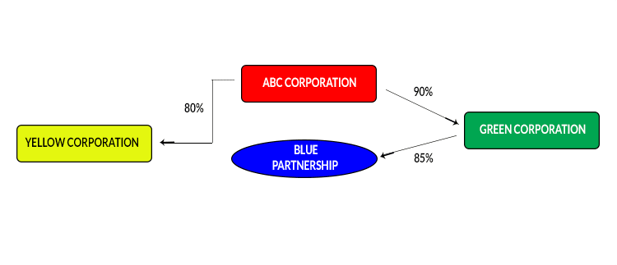

Example

ABC Corporation owns 90% of the stock of Green Corporation and 80% of the stock of Yellow Corporation. Green Corporation owns 85% of the profits of Blue Corporation.

ABC Corporation is the common parent of the parent-subsidiary controlled group consisting of ABC Corporation, Green Corporation, Yellow Corporation and Blue Corporation.

Brother-sister Controlled Group

A brother-sister controlled group exists when five or fewer individuals, estates or trusts own a controlling interest (80 percent or more) in each organization and have effective control. “Effective Control” generally means 50 percent of the organization’s stocks and profits, but only to the extent that the ownership is identical with respect to each organization.

Example

ABC Corporation and XYZ Corporation are owned by four shareholders in the following percentages:

| Share Holder | ABC Corporation | XYZ Corporation |

| A | 80% | 20% |

| B | 10% | 50% |

| C | 5% | 15% |

| D | 5% | 15% |

| Total | 100% | 100% |

In this example, the four shareholders together own 80% or more of the stock of each corporation. However, under the second component, the shareholders do not own more than 50% of the stock of each corporation, taking into account only the identical ownership in each corporation as demonstrated below:

| Shareholder | Identical Ownership in Both Corporations |

| A | 20% |

| B | 10% |

| C | 5% |

| D | 5% |

| Total | 40% |

Combined Controlled Group

A combined control group exists if three or more organizations are structured in the following way:

Each organization is either a member of a parent-subsidiary or brother-sister controlled group; and

At least one organization is the common parent organization of a parent-subsidiary controlled group and is also a member of a brother-sister controlled group.

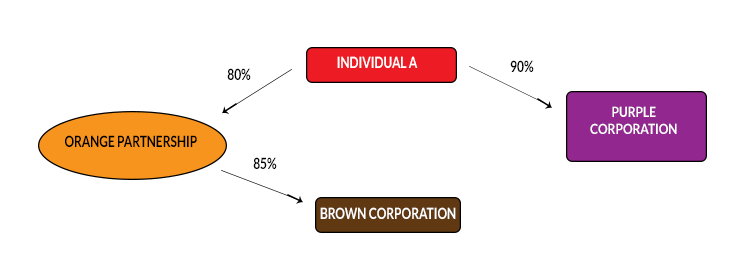

Example

A is an individual

How Being A Controlled Group Affects Your Health Insurance

If your company is commonly owned with other entities, it is important that you determine if your company is part of a controlled group.

When a business entity is considered a controlled group (as defined above), the business is considered a single employer under the ACA employer mandate.

So, all employees of companies within the same controlled group must be aggregated to determine whether the commonly-owned companies are subject to the employer mandate.

Once you have determined that you are a controlled group, you need to calculate if you are an applicable large employer (ALE) with at least 50 full-time equivalent employees (FTE).

If the combined total meets the 50 FTE threshold, then each separate company shall be considered an ALE subject to the ACA’s Employer Shared Responsibility provisions, even those companies that individually do not employ enough employees to meet the ALE threshold on their own.

As discussed in our previous article, if your business has at least 50 full-time equivalent employees (FTE), you are mandated to offer qualified and affordable health benefits or be subject to a tax penalty. This is typically referred to as the "employer mandate".

Summary

If a company is looking to avoid the “employer mandate’ by dividing their company into several smaller companies, they could be asking for trouble. If you are in a controlled group, applicable rules will place your company in the "employer mandate" category.

It is important to get advice from a broker who understands controlled groups and can help you be in compliance, so you can avoid substantial penalties.

“Statements on this website as to policies and coverage's and other content provide general information only and we provide no warranty as to their accuracy. Clients should consult with their licensed agent as to how these coverage's pertain to their individual situation. Any hypertext links to other sites or vendors are provided as a convenience only. We have no control over those sites or vendors and cannot, therefore, endorse nor guarantee the accuracy of any information provided by those sites or the services provided by those vendors.”